Table of Contents

Every startup founder, shipping executive, or cloud product manager is unknowingly an economist. Pricing a freight lane, a SaaS subscription, or even a football stadium ticket involves the same invisible forces that guide the chaiwala outside your office. This post unpacks economic efficiency, price controls, taxes, and elasticity but instead of chalkboard theory, we’ll ground it in shipping, sports, cloud, and startup data products.

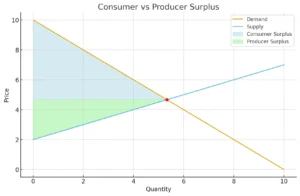

Surplus 101: Why Efficiency Matters in Business

At its core, every trade creates surplus:

-

Consumer Surplus (CS)

What customers were willing to pay what they actually pay.

Example: A shipping company was ready to pay $20 per container for AI-based optimization but got a SaaS subscription for $12. The $8 is untapped surplus. -

Producer Surplus (PS)

What businesses earn above their minimum acceptable price.

Example: A cloud provider may run compute for $0.15/hr but charge $0.20/hr, banking the surplus.

When both surpluses are maximized, we achieve economic efficiency.

This is exactly what every founder should want: a bigger total pie before debating how to split it.

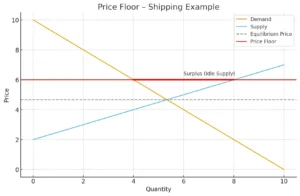

The Equity Efficiency Tradeoff: Shipping’s Daily Reality

Consider the chaiwala’s example: if demand drops from 15,000 to 14,000 cups at ₹2, prices shift, surplus redistributes, and the total pie shrinks. Economists call the lost value deadweight loss (DWL).

Now map this to shipping:

-

Container Freight Rates

If regulators impose a minimum freight rate, carriers may oversupply ships while shippers cut demand. Idle ships = surplus wheat in economics.

-

Winners

Shipping companies that get higher guaranteed prices.

-

Losers

Exporters who can’t afford capacity, leading to lost trade and DWL.

Lesson: Floors create “fairness” for one side but destroy efficiency. Logistics leaders must balance both.

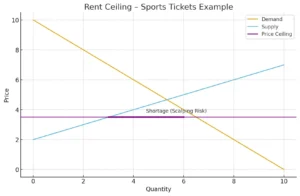

Rent Ceilings & Black Markets: The Sports Analogy

Sports stadiums, like urban apartments, often face price ceilings:

- Without ceilings: Equilibrium ticket price = $60, stadium filled efficiently.

- With ceilings: Government or league caps at $40 to “help fans.”

- Result: More fans want tickets than seats available → shortages and scalping. Tickets reappear on resale markets at $120.

This is the same as rent control in economics: good intentions, unintended consequences.

Parallel in IT: When regulators cap telecom/data pricing, startups may find capacity scarce or quality degraded, while shadow pricing (e.g., bundled premium plans) emerges.

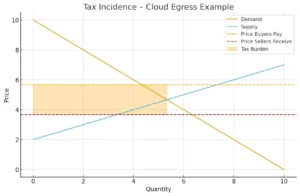

Taxes: Who Really Pays? (Cloud & Petrol Parallels)

Governments often tax to shift behavior or raise revenue. But incidence ≠ remittance.

-

Petrol Case

If the government imposes ₹24 tax, price rises from ₹40 to ₹56. Consumers bear ₹16, suppliers ₹8. Incidence depends on elasticity.

-

Cloud Case

Cloud egress fees act like a tax. A SaaS startup may forward AWS bills to customers, but depending on elasticity, both startup and customer share the burden:

- Inelastic workloads (must run): Customers eat the cost.

- Elastic workloads (easy to shift multi-cloud): Cloud providers may reduce margins.

Lesson: Taxes (or fees) reshape the surplus split, not just the payer list.

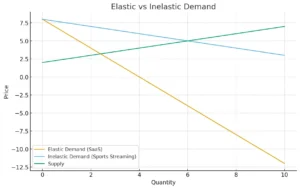

Elasticity: The Pricing Superpower for Startups

Elasticity measures how sensitive demand is to price changes:

-

Elastic demand (|E| > 1)

Small price drop → big usage jump.

Example: A logistics SaaS dropping per-container pricing can rapidly boost adoption. -

Inelastic demand (|E| < 1)

Price hikes don’t cut demand much.

Example: Sports streaming of exclusive events. Fans pay regardless.

Determinants:

- Substitutes (more = elastic).

- Time horizon (longer = more elastic).

- Necessity vs luxury (luxuries = elastic).

- Budget share (bigger = elastic).

Playbook:

- For elastic markets → cut prices or bundle, revenue grows.

- For inelastic → capture surplus carefully, protect trust.

The Startup & IT Founder’s Playbook

- Map surplus in your market: Where are customers leaving money on the table?

- Check elasticity before pricing: Freight SaaS is elastic; niche sports streaming is not.

- Avoid DWL in contracts: Don’t force rigid terms that waste value.

- Understand tax incidence: Cloud fees, compliance costs who really bears them?

- Balance equity & efficiency: Fairness builds loyalty, efficiency builds scale.

Conclusion

From chai stalls to container ports, from rent ceilings to cloud egress fees the same economics runs the show. Startups and IT leaders who master surplus, elasticity, and efficiency can design better products, smarter pricing, and resilient ecosystems.

In the end, economics isn’t just theory. It’s the invisible playbook running your SaaS revenue, your shipping lane pricing, and even your favorite team’s ticket sales.